Executive Summary

-

Explore how predictive analytics is reshaping investment strategies.

-

Understand the benefits and challenges of integrating AI in investment decisions.

-

Discover real-world examples of successful AI-powered investment models.

-

Gain expert insights on leveraging predictive analytics for capital structuring.

Introduction

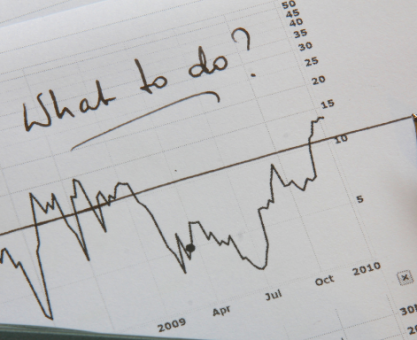

In the rapidly evolving world of finance, investors face a daunting challenge: making informed decisions in an environment awash with data. Predictive analytics, powered by artificial intelligence, offers a revolutionary approach to investment strategies, enabling investors to anticipate market trends and make data-driven decisions. This article delves into how predictive analytics is transforming investment strategies, its benefits, challenges, and practical applications for investors today.

Definitions / Context

Predictive analytics involves using AI algorithms and statistical techniques to analyze historical data and predict future outcomes. In the investment sphere, it means leveraging vast datasets to foresee market movements, assess risks, and identify potential opportunities.

Benefits / Pros

-

Enhanced Decision-Making: Predictive analytics provides insights into market trends, allowing investors to make proactive rather than reactive decisions.

-

Risk Mitigation: By forecasting potential market downturns, investors can adjust portfolios to minimize losses.

-

Increased Efficiency: Automating data analysis frees up time for strategists to focus on high-level decision-making.

-

Personalization: Tailors investment strategies to individual investor profiles based on historical behavior and preferences.

Risks / Cons / Challenges

-

Data Quality Issues: Predictive models are only as good as the data they rely on, making data integrity crucial.

-

Overreliance on Technology: Investors may depend too heavily on AI, underestimating human judgment and external factors.

-

Regulatory Compliance: Navigating the complex regulatory landscape for AI in finance can be challenging.

How to Integrate Predictive Analytics into Your Investment Strategy

-

Assess Data Sources: Evaluate the quality and relevance of your current data.

-

Choose the Right Tools: Select AI platforms that align with your investment goals.

-

Model Development: Develop models by collaborating with data scientists to tailor algorithms to your needs.

-

Testing and Validation: Run simulations to test model accuracy before full implementation.

-

Continuous Monitoring: Regularly update models and data inputs for ongoing accuracy and relevance.

Consider the case of XYZ Capital, which integrated predictive analytics into its investment strategy. By leveraging AI to analyze market trends, XYZ Capital increased its annual returns by 15% while reducing portfolio risks significantly. This shift allowed the firm to capitalize on emerging market opportunities and enhance its competitive edge.

— XYZ Capital

Expert Tips / Strategic Insights

-

Diversify Data Sources: Epiidosis recommends combining traditional financial data with alternative datasets, like social media sentiment analysis, for a comprehensive view.

-

Stay Updated: Regularly update your AI tools and models to reflect the latest market developments and technological advancements.

-

Collaborate with Experts: Partner with AI specialists to ensure efficient model implementation and maintenance.

Tools / Resources / Calculators

-

DataRobot: A platform for automating machine learning processes.

-

Alteryx: A tool for data blending and advanced analytics.

-

QuantConnect: Provides algorithmic trading and quantitative analysis tools.

Conclusion

Predictive analytics is undeniably the future of investment strategies, offering a powerful tool for anticipating market trends and optimizing portfolios. By understanding its benefits and challenges, investors can leverage AI to make informed, strategic decisions. Start integrating predictive analytics into your investment strategy today for a competitive advantage.