Executive Summary

-

Offshore wind energy is gaining traction as a sustainable investment opportunity.

-

The sector promises high returns but comes with significant environmental and regulatory challenges.

-

Investors must understand the technological advancements and geographic considerations that influence project success.

-

Strategic insights and tools can help mitigate risks and maximize investment benefits.

Introduction

As the global demand for renewable energy surges, offshore wind presents a promising opportunity for investors seeking sustainable growth. Unlike traditional energy sources, offshore wind offers the dual benefits of reducing carbon footprints while providing substantial returns. This article explores the intricacies of investing in offshore wind—uncovering its potential, challenges, and the strategies that can lead to long-term success in this rapidly expanding sector.

Definitions / Context

Offshore Wind Energy:

The generation of electricity using wind turbines located in bodies of water—typically oceans or large lakes—where wind speeds are higher and more consistent than on land. It plays a critical role in global decarbonization goals and renewable energy strategies.

Benefits / Pros

-

High Energy Potential: Offshore wind farms typically generate more electricity due to stronger, more stable wind conditions compared to onshore sites.

-

Environmental Impact: Reduces dependence on fossil fuels and lowers greenhouse gas emissions, contributing to climate goals.

-

Government Incentives: Many countries provide subsidies, tax breaks, and streamlined permitting processes to boost renewable energy investments, particularly in offshore wind.

Risks / Cons / Challenges

-

High Initial Costs: Development, construction, and maintenance of offshore wind farms involve significant upfront capital.

-

Regulatory Hurdles: Complex permitting processes and maritime laws can delay projects and add to costs.

-

Environmental Concerns: Potential effects on marine biodiversity and local ecosystems must be assessed and addressed responsibly.

Step-by-Step Process

How to Invest in Offshore Wind

-

Research and Market Analysis

Study global trends, regional performance, and government targets in offshore wind deployment. -

Regulatory Compliance

Understand and navigate environmental regulations, maritime laws, and energy grid connection requirements. -

Partnerships

Collaborate with experienced project developers, engineering firms, and turbine manufacturers. -

Financial Planning

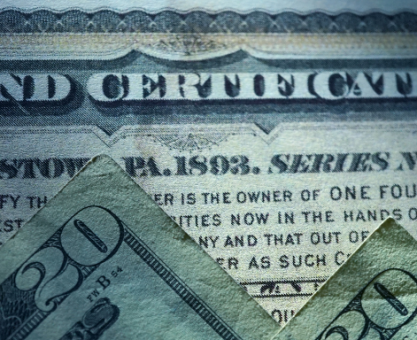

Structure investment models using tools like green bonds, private equity, or joint ventures. -

Ongoing Monitoring

Implement systems for real-time performance tracking, maintenance forecasting, and environmental impact assessments.

A European consortium of investors partnered to develop a large-scale offshore wind farm in the North Sea.

By leveraging favorable policies and advanced floating turbine technology, the project was completed ahead of schedule.

It now powers over 1.5 million homes and has delivered an ROI of 18% over five years.

This case illustrates how strategic location, technology, and partnerships can drive successful offshore wind investments.–North Sea Offshore Wind Farm

Expert Tips / Strategic Insights

-

Embrace Technological Innovation: Invest in next-gen technologies like floating turbines and AI-powered asset monitoring to enhance efficiency and reduce operational risk.

-

Diversify Across Regions: Minimize geopolitical and weather-related risks by investing in projects across different jurisdictions.

-

Adopt a Long-Term Mindset: Offshore wind offers steady returns over decades; patience and sustained capital allocation are crucial for long-term profitability.

Tools / Resources / Calculators

-

Wind Energy Calculator

Estimate potential energy output and returns based on wind speed, turbine specs, and location. -

Offshore Regulatory Checklist

Detailed documentation of permitting, safety, and compliance requirements by country or region. -

Investment Guide (Downloadable)

A practical PDF guide covering offshore wind market insights, legal frameworks, and funding models.

Conclusion

Offshore wind energy stands at the intersection of environmental responsibility and financial opportunity. It offers investors a chance to contribute to a cleaner future while earning stable, long-term returns. Despite the challenges—such as regulatory complexity and high capital needs—the offshore wind sector is becoming a central pillar of the global energy transition. With the right knowledge and strategic partnerships, investors can unlock powerful returns while fostering a sustainable tomorrow.